So in one of our earlier posts we discussed How to set a budget that actually helps your business growth and why this is such a critical part of planning for your business.

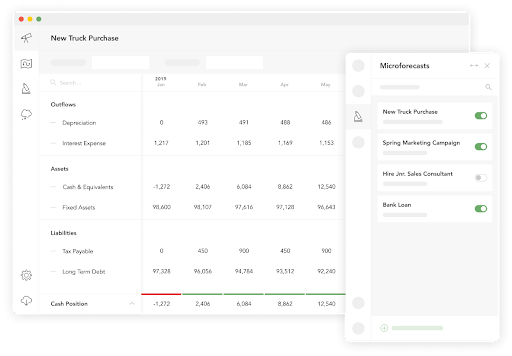

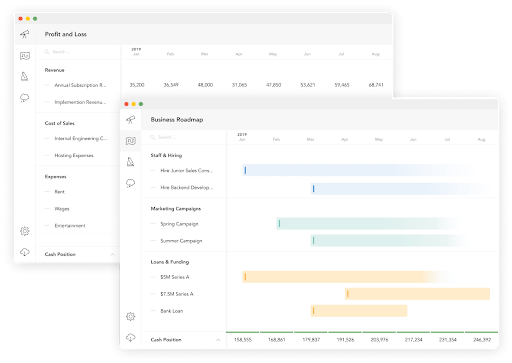

Whilst a budget is a ‘forecasting tool’, a budget is not a cashflow forecast. Simply put, the budget primarily focuses on your profit and loss (the money in and out of your business) whereas a cashflow forecast details what is happening with your cash in ‘real time'.

“Entrepreneurs believe that profit is what matters most in a new enterprise. But profit is secondary. Cash flow matters most.” - Peter Drucker

One of the most important aspects of a forecast is having the ability to reduce the risks of decision making by seeing the impact of decisions before they are made.

Business Costs are Increasing

With inflation rising at its fastest rate in 30 years, businesses are now looking at the impact this will have on:

Wages and Salaries

For many businesses, wage increases will need to be given to staff members in the region of 8% if not more, to keep pace with inflation. Many businesses have not factored this into their planning for 2022 and could have a significant impact and either mean more redundancies or investments being postponed as there simply isn't the money available once increases have been applied.

Energy Costs

We have already seen the impact of energy prices increasing in the region of 50%, with more increases planned for October, if the energy price cap goes up again.

Whilst recent events in Ukraine can be seen as far away, the impact is hyper local and the Bank of England have warned that inflation could hit double digits by the end of the year.

How can Valued help you?

What if we could give you an insight into the future, to show you the options you have and the impact of your decisions before you made them?

We know that would be a game changer for you.

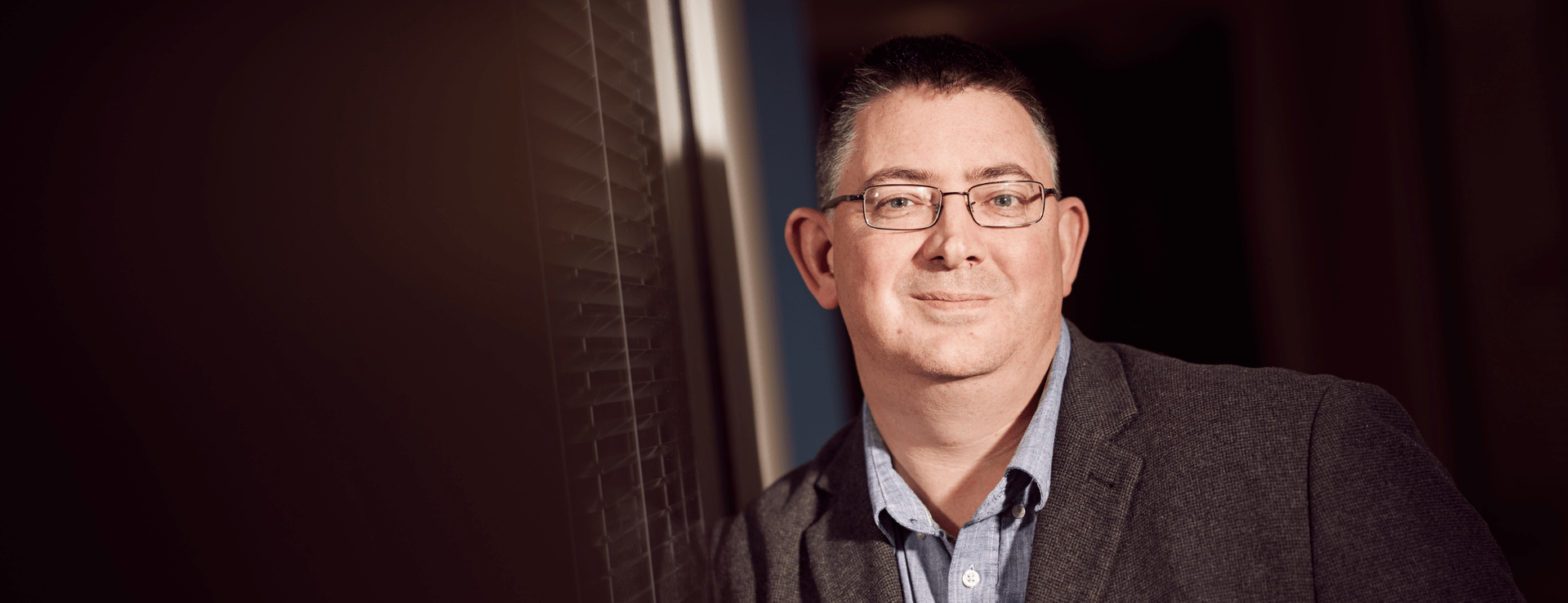

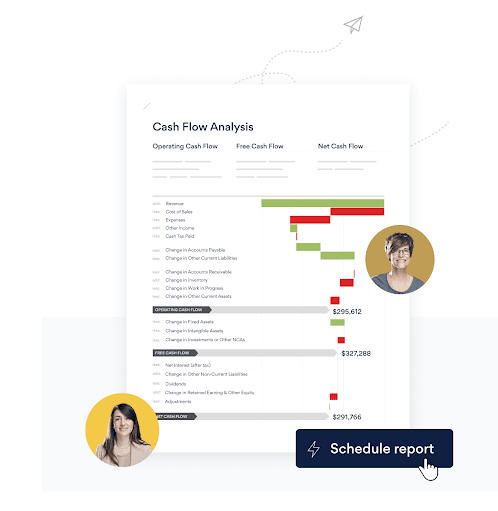

We can help you by creating a cashflow forecast that can take into account all of the events that will have an impact on your business and factor those into an action plan.

Planning ahead with confidence

Our clients like that we can handle this whole process for them and share our insights and knowledge to maximise the outcomes for them. As the data is synchronised directly from Xero, our clients are safe in the knowledge that we are working with the most up to date information and working with you to plan the outcomes that you want, no nasty surprises.

Other benefits

We can work with you to minimise your late payments and identify areas for growth and improvement including those allowances that you could be claiming for working from home.

At Valued, we truly want to be a part of your business success, and are here to support you not just at the year-end with accounts and tax returns but at every single step of your journey. We believe that every business needs to have a cash-flow forecast and know that businesses and our clients succeed more, working with us in a more comprehensive way.

To find our more click here or drop an email to wecare@yourvalued.co.uk